What is a deferred interest promotion?

A Deferred Interest Promotion is an offer that may be available on your purchase. With this offer, interest accrues (adds up) on your account from the purchase date, but is only charged if you do not pay off your promotional balance within the defined promotional period.

This promotional financing offer is typically advertised as special financing, promotional financing or No Interest If Paid In Full Within X Months, where X is the number of months in the promotional period.

How It Works

With a deferred interest promotion, a minimum monthly payment is required, and varies based on your balance and account terms. No interest will be charged on the promotional purchase balance if you pay it off in full within the applicable promotional period.

Even though you're not paying interest on your promotional purchase balance during this period, interest is still accruing on that balance at the standard rate for your account. If you do not pay off this balance in full before the end of the promotional period, then the interest that has been accruing from the date of purchase will be added to your account and you will be required to pay it.

PROMOTIONAL FINANCING EXAMPLES

Below are 3 different ways a cardholder could make payments on a deferred interest promotion.*

These examples are for illustrative purposes only and assume the cardholder made a purchase of $1200 using a “No Interest if Paid in Full Within 6 Months” promotion. They also assume the cardholder’s APR (interest rate) is 26.99% and the amount financed is the only balance on the account. Your account's APR and/or required minimum monthly payment may be different.

| Payment Approach | Month One | Month Two | Month Three | Month Four | Month Five | Month Six |

|---|---|---|---|---|---|---|

| Cardholder A: Suggested Equal Monthly Payments |

$200 | $200 | $200 | $200 | $200 | $200 |

|

Cardholder A makes six monthly payments, each equal to the total promotional purchase amount divided by six, paying off the full balance within the promotional period. Result: Outcome at end of Account Balance $0 No Interest Charged |

||||||

How To Read A Statement

Click or roll over the section titles below and find out what each section of your statement means. For illustrative purposes only. Your actual statement may differ from this sample.

›Auto Payment of $500 set for 1/18/2019

Late Payment Warning: If we do not receive your total Minimum Payment Due listed above you may have to pay a late fee of up to $38.88.

Minimum Payment Warning: If you make only the minimum payment each period, you will pay more interest and it will take you longer to pay off your balance. For example:

| If you make no additional charges using this card and each month you pay... | You will pay off the balance shown on this statement in about... | And you will end up paying an estimated total of... |

|---|---|---|

| Minimum Payment | 14 Years | $6,554.00 |

| $98.00 | 3 Years | $3,538.00 (Savings = $3,016.00) |

If you would like information about credit counseling services, call 888-555-1212

Payments must be received by 5pm ET on 1/23/2019 for online and phone payments.

Notice:We may convert your payment into an electronic debit. See reverse for details, billing rights and other important information.

New York residents may contact the New York State Department of Financial Services by telephone at 1-800-342-3736 or visit its website http://www.dfs.ny.gov/consumer/creditdebt.htm for free information on comparative credit card rates fees and grace periods.

Late Payment Warning: If we do not receive your total Minimum Payment Due listed above you may have to pay a late fee of up to $38.88.

Minimum Payment Warning: If you make only the minimum payment each period, you will pay more interest and it will take you longer to pay off your balance. For example:

Account Summary

›Auto Payment of $500 set for 1/18/2019

Previous Balance as of 11/30/2018

$2,222.00

Payments

-100.00

Other Credits

-5.00

Purchases & Other Debits

+500.00

Balance Transfers

+000.00

Cash Advances

+000.00

Fees Charged

+000.00

Interest Charged

+23.32

Credit Limit

$6,800

Available Credit

$4,159

Interest Charged

$1,360

RockRed Gold Rewards Summary

Rewards Earned This Year

$15.00

Points to Next Reward

88

See page 3 for details.

Auto-payment of $500 set

for 01/18/2019

Account Ending

New Balance

$2640.32

Total Minimum Payment Due

$50.00

Payment Due Date

01/23/2019

Amount

Enclosed ![]()

RockRed Gold Rewards Detail

Previous Balance as of 11/30/2018

$2,222.00

Payments

-100.00

Other Credits

-5.00

Purchases & Other Debits

+500.00

Balance Transfers

+000.00

Cash Advances

+000.00

Fees Charged

+000.00

Interest Charged

+23.32

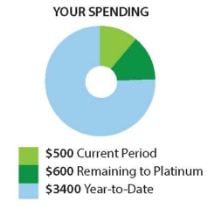

Only $600 to Platinum Rewards

Spend $600 in store on your RockRed card by February 28, 2019 and lock in these Platinum benefits:

- Free shipping

- Special monthly coupons

- Bonus points

For information on earning redeeming awards visit RockRedRewards.com.

| Purchase Date | Purchase Amount/Special Terms | Deferred Interest Charges | Promotional Balance | Expiration Date |

|---|---|---|---|---|

| 02/05/2018 | $1,441.51/No Interest With Min Pay | $0.00 | $1,363.87 | 01/31/2019 |

Please see the table above for information about any promotions(s) on your account:

DEFERRED INTEREST PROMOTIONS:To avoid paying Accrued Interest Charges you must pay the appliable Promotional Balance in full by the Expiration Date.

NO INTEREST PROMOTIONS:No interest will be assessed on the promotional balance during the promotional period.

FIXED PAY/REDUCED APR PROMOTIONS:Interest at a reduced rate will be assessed on the Promotional Balance and fixed payments will be required.

EQUAL PAY/NO INTEREST PROMOTIONS:No interest will be assessed on the Promotional Balance and equal payments will be required.

To make more than one payment, you can pay online at the online address stated above or you can mail in your payment to the address on the remit stub.

![]() If your account has a Deferred Interest balance and you would like us to apply a payment to a specific promotional balance or non-promotional balance, please call Customer Service at 1-866-123-4567 to learn what options may be available.

If your account has a Deferred Interest balance and you would like us to apply a payment to a specific promotional balance or non-promotional balance, please call Customer Service at 1-866-123-4567 to learn what options may be available.

Transaction Detail

| Date Reference # | Description | Amount | Plan Type |

|---|---|---|---|

| Payments | -$100 | ||

| 12/10 | Payment received - thank you | -$100 | |

| Other Credits | -$5.00 | ||

| 12/14 | Special credit offer | -$5.00 | |

| Purchases and Other Debits | -$500 | ||

| 12/11 TS1234567880XYZHQ | RockRed 003874 Dawsonville, GA; Timberland Mens's Hiking Boot | $110.00 | reg |

| 12/11 TS1234567880XYZHQ | RockRed 003874 Dawsonville, GA; Timberland Mens's Hiking Boot | $110.00 | reg |

| 12/11 TS1234567880XYZHQ | RockRed 003874 Dawsonville, GA; Timberland Mens's Hiking Boot | $110.00 | reg |

| Total Fees Charged This Period | $0.00 | ||

| 12/31 | Fees for this period | $0.00 | |

| Total Interest Charged This Period | $23.32 | ||

| 12/31 | Interest charged on purchases | $23.32 |

| 2018 Fees and Interest | Year-to-Date |

|---|---|

| Total Fees Charged | $0.00 |

| Total Interest Charged | $23.32 |

| Total Interest Paid | $19.59 |

Interest Charge Calculation

Your Annual Percentage Rate (APR) is the annual interest rate on your account

(v) = Variable Rate

| Type of Balance | Expiration Date | Annual Percentage Rate | Balance Subject to Interest Rate | Interest Charge |

|---|---|---|---|---|

| Regular Purchases | N/A | 24.15%(v) | $1,136.92 | $23.32 |

| Cash Advances | N/A | 27.15%(v) | $0.00 | $0.00 |

| No Interest With Min Pay | 01/31/2019 | 0.00%(v) | $0.00 | $0.00 |

Eligible card purchases may be billed under on of the following promotions:

NO INTEREST FOR 6 OR 12 MONTHS: For each promotion, after the promotion ends, a 24.15% APR will apply. If (v) is shown after your APR in the Interest Charge Calculation section of this billing statement, the APR is a variable rate and will vary with the market based on the Prime Rate Minimum monthly payments are required.

NO INTEREST IF PAID IN FULL WITHIN 6, 12, 18 OR 24 MONTHS: Under each of these promotions, if the promotional balance is not paid in full within the prmotiona period, interest will be imposed from the date of purchase at a rate of 25.15%. If (v) is shown after your APR in the Interest Charge Calculation section of this billing statement, the APR is a variable rate and will vary with the market based on the Prime Rate Minimum monthly payments are required.

See promotional advertising for further details.

Cardholder News and Information

Please Note:Enclose is the Privacy Policy for this account. Please take a moment to read it then keep it with other financial documents. If you have previously opted-out, you do not need to do so again.

Synchrony Bank may continue to obtain information including employment and income information from others about you(including requesting reports from consumer reporting agencies and other sources) to review, maintain or collect your account.

Cahsier checks and Loan Transfer Checks are not acceptable forms of tender when making your payment in RockRed.

Cardholder Benefits and Information

Sign up for electronic statements - just go to www.rockred.com/ebill.

FAQ

Have questions? We have answers.

There are numerous types of credit promotions that may apply to specific transactions. Merchants who accept the card determine which offers are available for purchases made at their location. Please refer to the advertising or offer disclosures provided to you at the point of sale for information about promotional financing offer(s) that may be available for a particular purchase.

No, Deferred Interest promotions accrue interest from the purchase date which will be billed to your account if the promotional balance is not paid in full within the promotional period.

No, Deferred Interest promotions are not the same as No Interest promotions. For Deferred Interest promotions, interest will accrue from the purchase date and will be charged to your account if the entire promotional balance is not paid in full within the promotional period. No Interest promotions do not accrue interest during the promotional period and may or may not charge interest going forward after the promotional period ends.

Yes, Deferred Interest promotions require a minimum monthly payment; however, these minimum payments are NOT guaranteed to pay the promotional balance within the promotional period. You may have to pay more than the minimum monthly payment to avoid accrued interest charges. This is important to do since if you don’t pay off the promotional balance within the promotional period, interest will be charged to your account from the purchase date.

Minimum monthly payments, based on a percentage of your account balance or a minimum amount, are required in accordance with the standard account terms. It is very important to note that the required minimum monthly payments may or may not pay off your purchase by the end of the promotional period. If you want to ensure that your purchase is paid before the end of the promotional period (to avoid interest), you should schedule additional or larger payments accordingly. See the Promotional Financing Examples section for payoff examples.

Pay your promotional balance in full before the end of the promotional period to avoid interest.

Interest will be charged to your account from the purchase date if the promotional purchase balance is not paid in full within the promotional period. Although interest will accrue at the standard purchase rate applicable to your account, it will only be assessed and added to your account as a lump sum at the end of the promotional period if the promotional purchase balance is not paid in full by the expiration date shown on your statement. To avoid paying interest, be sure to pay your promotional purchase balance by the expiration date.

There will be information on your billing statement about how long it will take to pay off your account if you only make minimum monthly payments.

One type of Revolving Credit is a credit card with a designated credit limit that can be used over and over to make purchases at any location where the card is accepted.

*Subject to credit approval. Minimum monthly payments required. Not all promotional financing options are available at all retailers. Ask yours for details.